The 2013 stats are in. On trend with previous years, the Realtors® at RE/MAX Banner represented far more buyers and sellers than any other brokerage in the Valley. We are where the buyers are, and our listings take priority. Whose sign do you want on your lawn?

Author Archives: colincrowell

Is Your Electricity Bill Sky High?

Have you noticed a spike in your power bill lately? Here are some helpful tips that might explain why!

- Do you have an electric water heater? It may be worth having someone look at this to ensure it is functioning properly. If it’s older, a failing element can cause it to draw much more power than usual.

- Do you have electric baseboards? Cold weather will obviously cause these to come on more frequently, but check for air gaps & drafts in an effort to overcome heat loss.

- Are you living in a duplex, condo or other apartment? It’s possible that a neighbour might have something wired into you by mistake (or intentionally!)

- Some newer washers & dryers have an “automatic” mode which will cause them to turn on and off at odd hours without your knowledge. Make sure this feature isn’t turned on!

- How old are your appliances? Older fridges and freezers, especially when beginning to fail, will draw obscene amounts of power. Additionally, check the seals for air gaps which will cause the unit to run more, and suck more juice.

- Do you have any new gadgets in the house? New TVs, computers, stereos, etc can all contribute to your consumption.

- It may seem silly, but check infrequently power outlets, for example, in the garage. Is something plugged in that never used? I discovered a radio in my garage that was plugged in all winter, on very low volume. It doesn’t seem like much, but this could have amounted to a lot of money in the long run!

- Is there a gamer in the house? New video game consoles draw a lot of power and are running constantly.

- Finally, if you’ve noticed a big power spike and nothing else seems to explain the problem, make sure your meter isn’t damaged or malfunctioning. Shut off all breakers and check to see that it isn’t still spinning!

Preparing Your Home for the Market

Studies have shown that a properly preparing your home does help sell at the best price, in a shorter period of time. In my experience, a lack of attention to detail makes buyers wonder what else might be getting neglected around your home. It sounds silly, but if the house isn’t clean, this can suggest to some people that this “neglect” could extend to regular maintenance of your home’s services (for example, the fireplace, furnace, eaves-troughs, etc).

Lawns & Yard

- Remove clutter

- Cut grass

- Edge walkways

- Trim hedges

- Weed gardens

Exteriors

- Paint &/or touch up any areas that need improvement

- Repair and wash railings, steps, screen doors, gutters, etc.

Garage

- De-clutter

- Organize

- Paint interior.

Plumbing

- Repair leaky faucets & toilets

- Clean sinks & tubs.

- Replacing old toilets will often produce a high return.

Furnace & Fireplace

- Clean furnace & vents of dust and dirt.

- Clean fireplace; set a small fire to demonstrate functionality if weather permits!

- It is strongly recommended you have your fireplace WETT certified.

Electrical

- Replace burned out bulbs, consider installing new high-efficiency bulbs.

- Replacing switch & receptacle covers can provide a big return on investment!

Carpets & Floors

- Clean thoroughly. Give a quick sweep or vacuum before showings if necessary.

Hardware

- Oil hinges, tighten door knobs, and polish shiny surfaces.

General Considerations

- Dust, wash, paint, repair anything and everything that may have been neglected in recent years; store unneeded items and extra furniture off-site.

- Pets, children and adults can prevent buyers from feeling at ease; it is suggested the home be vacant for every showing, if possible.

- Before a showing, open drapes, open windows (if a nice day), and avoid cooking strong-smelling foods. Your home should be “fresh” for every showing.

RE/MAX has created a comprehensive package of videos and checklists on the top 10 priorities for preparing a property for sale. For more information, visit FitToSell.ca!

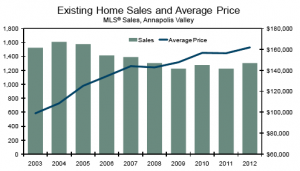

In depth: 2012 Annapolis Valley Real Estate Statistics by County

A few weeks ago, I drew some conclusions regarding the state of the Annapolis Valley Real Estate market in 2012 over 2011. Unfortunately, these stats included data for all properties, across all counties as opposed to just pre-existing homes (in other words, we are removing new home construction from the equation). It left a lot to the imagination. That said, I am pleased to present a more in-depth analysis of the pre-existing homes market, analysed by County. This information will be most useful for current home owners looking to sell, or anyone looking to buy an existing home here in one of the Annapolis Valley’s four counties.

This analysis is based on a report recently released by the The Canadian Mortgage and Housing Corporation (CMHC). It is provided here for your interpretation & use.

Valley-wide, average sale price increased 3.5% to $161,915 and unit sales increased 6.4% to 1300 units. Over half of these sales were reported in Kings County alone. Kings county was a major contributing factor to this year’s increase.

Anyone living in Annapolis County may initially be concerned to see that our numbers were off slightly this year. Unit sales were down 8 units (281 vs 273), and the average sale price declined 3.3% to $133,584. However, I feel that this is merely a correction from a large spike we saw in 2011: average sale price was up a whopping 12.8%, where every other county saw a decline. This was an anomaly and it’s difficult to offer a simple explanation for why this may have happened. Averaging the yearly increases/decreases reveals that Annapolis County is still on par with longer trends and is still enjoying steady, predictable growth:

| Annapolis County 5-year trend (2008-2012) | |

| MLS® Average Unit Sales | 286 |

| MLS® Average Sale Price increase | 3.08% |

Kings County‘s numbers are an encouraging sign of things to come for the Valley as a whole. The county is leading our region’s growth both in terms of units sold and average sale price increases:

| Kings County 5-year trend (2008-2012) | |

| MLS® Average Unit Sales | 660 |

| MLS® Average Sale Price increase | 4.85% |

Digby County has experienced impressive growth in terms of unit sales: in 2008 total units sold was 95, jumping to 146 units only 5 years later. This is an increase of over 53%. However, average sale prices have not improved, hovering around the $100,000 mark.

| Digby County 5-year trend (2008-2012) | |

| MLS® Average Unit Sales | 118 |

| MLS® Average Sale Price increase | -0.5% |

Finally, looking again at the 5-year trend, Hants County appears to be the least stable market and shows significant fluctuation year over year. One may speculate that this is due to its proximity to Halifax county, where housing prices and market activity are more heavily influenced by socio-economic factors. Nonetheless, the county has still enjoyed respectable growth and 2012 units sold were up significantly (219 over 192 units in 2011).

| Hants County 5-year trend (2008-2012) | |

| MLS® Average Unit Sales | 200 |

| MLS® Average Sale Price increase | 1.23% |

I could go on and on. Ultimately what’s important to you, the consumer, depends largely on your individual circumstance. That said, I’m always happy to discuss the market, and how it may apply to your unique buying or selling demands!

Accolades from the IWK

We received a very nice phone call from a representative of the IWK Health Centre today.

He wanted to thank our Company and all the agents of REMAX Banner Real Estate for our recent contributions, and also for previous ones. Since the program began 10+ years ago, RE/MAX Banner Real Estate has contributed over $100,000 to the IWK, between agent and company contributions.

This is just another way we say “thanks!” to our clients & community for your patronage!

Year-End Market Report, 2012 vs 2011

Let’s compare the market from 2012 to 2011. Here are some interesting yet not surprising year-end stats (Source: Annapolis Valley Real Estate Board).

Average sale price, 2011: $163,161

Average sale price, 2012: $165,607 (1.5% increase)

Sales to listing ratio, 2011: 38%

Sales to listing ratio, 2012: 41% (3% improvement)

Total number of properties listed, 2011: 2,972

Total number of properties listed, 2012: 3,032 (2% increase)

For the most part, these numbers are on trend. Here in the Annapolis Valley we enjoy predictability: slow yet steady growth, year over year. We have largely avoided the pitfall of market “bubbles” and uncontrollable growth, making real estate a fairly stable investment. The list to sale ratios still suggest that we are in a buyer’s market.

If you feel like it might be time to take advantage of historically low interest rates, please give me a call. I’d be happy to discuss a specific property you might have in mind and share my thoughts on its viability from an investment perspective.

Off the Grid and Eco-Friendly Living in the Annapolis Valley of Canada

More and more I am fielding requests from those who see the Annapolis Valley as an ideal location for off the grid and/or eco-friendly living. And they’re looking here for good reason. We have unbelieveably low land prices & housing costs, especially when considering some of the advantages of living here: top quality soil, perfect growing conditions, access to many pristine waterways, excellent forests, and countless folks who are already engaged in creating an active community based around trade, skill-sharing and green living, to name a few. A lot of our energy is already generated through green means – tidal, hydro and wind generation, and our provincial government strongly encourages eco-friendly housing through numerous rebate and incentive programs. We enjoy a slow pace of living here in the Maritimes, but stay on top of technology and economic trends. The gravitation toward community-based, eco-friendly living has been in full effect for many years, yet this trend seems to have fallen under the radar of many seeking such a lifestyle. So I’m announcing to the world: if the place I’m describing sounds like it might fall in line with your hopes and dreams, you are welcome here! Give me a call if you’d like to consider “starting fresh” in the Annapolis Valley; I’d love to hear your story and suggest a few properties to get you started.

Launch of ValleyListings.ca

I am pleased to announce the official launch of RE/MAX Banner Real Estate’s new web site and MLS search service, ValleyListings.ca. This site is the culmination of many months of research an hard work alongside our extraordinary developer Gerry Watson of Snowbound Studios. It allows access to all Annapolis Valley MLS listings on an intuitive map. If you’re looking for property in the Valley, I’m confident it will become an integral part of your search experience. And if you’re listing, this is yet another example of how RE/MAX Banner and myself are “Above the Crowd!” when it comes to online promotion of your property. Enjoy! I welcome your direct feedback on how we can continue to improve this experience.

RE/MAX Banner Real Estate Receives Award

The brokerage I work for, RE/MAX Banner Real Estate, was awarded for being the top contributor to the Canadian Breast Cancer Foundation out of all Atlantic Canadian RE/MAX offices in 2011. Just one of the many ways we continually give back to our community!

RE/MAX in Canada is on Fire!

RE/MAX placed 161 brokerages in the REAL Trends Canadian 250, a ranking of Canada’s largest brokerages by total 2011 transaction ends. The closest competitor, Royal LePage, had 23 brokerages qualify.

With the survey expanded by 50 brokerages this year, RE/MAX picked up 24 more slots than last year. RE/MAX brokerages qualified for 137 of the 200 placings in the 2011 REAL Trends Canadian 200.

Combined, the 250 brokerages closed 474,612 ends in 2011. RE/MAX brokerages accounted for 59% of them. The full report, which yields data for ends-per-agent comparisons, is expected to be released soon. See the overall rankings.

Here are the total number of brokerages from each franchise that made the cut for the REAL Trends Canadian 250:

-

RE/MAX: 161

-

Royal LePage: 23

-

Coldwell Banker: 21

-

Keller Williams: 12

-

Century 21: 6

-

Exit: 6

-

Prudential: 5

-

Sutton: 5

-

Sotheby’s: 1

This in mind, who would you want working on your side when it comes to buying and selling a home? Choose the brand with the most experienced agents!